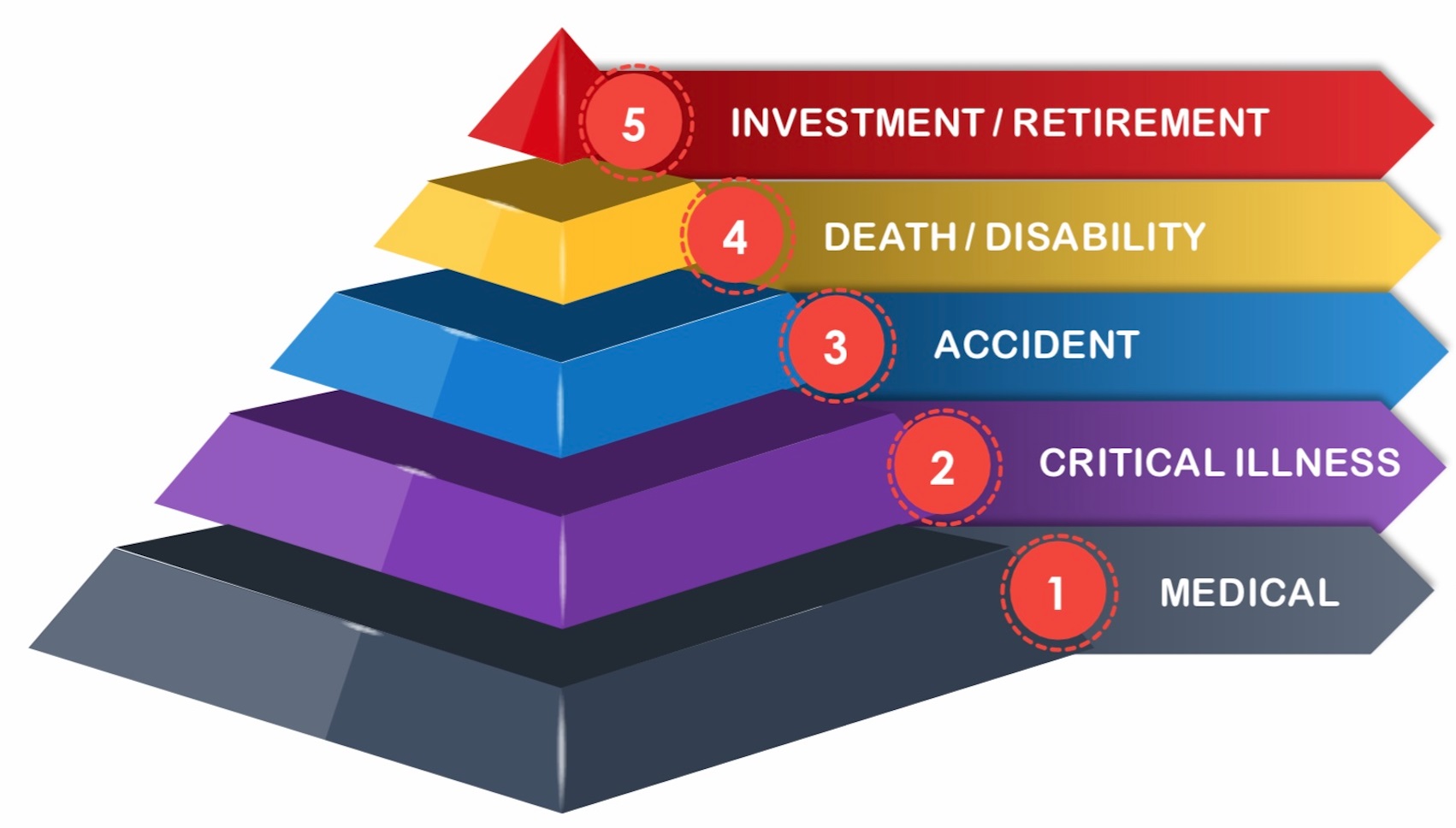

5 INSURANCE COVERAGE YOU NEED TO HAVE

Insurance is an important part of our life. When we buy a car, we cannot drive without car insurance. When you buy your first house, you need a home insurance. When you take a loan from the bank, they ask for a life insurance.

There are different types of insurance policies to choose from. It varies from companies offering them, with variations on the coverage and benefits. For most people, insurance topic can be so technical and very hard to understand.

MEDICAL INSURANCE

For some wealthy nations, medical insurance for their citizens are free of charge. But for most countries, you need to buy for yourself. Medical policies gives you coverage against hospitalization. They simply shoulder the bill in case you get hospitalized or needs treatment. This is the most important insurance we can get for ourselves, considering how expensive it is nowadays to get hospitalized. There are several types of health insurance to choose from depending on the country where you reside. Choose the one that suits you most.

CRITICAL ILLNESS INSURANCE

This plan gives you lump sum amount in the event of critical illness diagnosis. All of us will incur at least two or more critical illnesses in our lives. The only question is what and when. When we say critical illness, I am not just referring to cancer, heart attack and stroke. These are the 3 most common illnesses. However, critical illnesses covered nowadays are enhanced with several illnesses on the list. Even the slight loss of hearing, burns and loss of vision are now covered. It is important to seek advice from your local insurance provider for such coverage. Make sure you get a policy that covers all stages of illnesses, not just the major stage.

ACCIDENT INSURANCE

As the name implies, it gives you coverage in the event of accident. It provides accidental death benefit, dismemberment benefit and accident medical treatment coverage. Most of the time, it cover’s worldwide. Among the insurance policies you can avail, this is the cheapest. Yet, it also gives an important coverage for our self. Sometimes, medical policy only covers inpatient treatment. Thus, accident outpatient may not be covered. If you have accident plan, it covers both inpatient and outpatient treatment as long as it is due to accident.

DEATH/DISABILITY INSURANCE

This is mostly for our beneficiary. It’s a legacy we can give to them in the event of an untimely death. When you get this policy, these 2 coverages are usually bundled together. In the event of death or total disability, the policy will terminate and the client will receive the payout. Death can be of any cause. It is only the total disability condition that sometimes confusing as there can be ways how to interpret this base on your insurance company. For example, cases like bed ridden, paralyzed, wheelchair bound and in coma can be categorized as total disability and qualified to file for claim under total disability cover. It is always best to consult your local insurance company for their exact condition for claim under this policy.

INVESTMENT/RETIREMENT INSURANCE

Once you are OK with all other insurance, you can now make your money grow and prepare for your retirement. This should be recommended last as there is no point investing and planning for retirement without the basic insurance first. In case of worst scenario, you may end up selling all your investment policies at a loss if you need money for medical bills. With this policy, your main goal now is to invest for the future.

Do you own diligence in buying personal insurance. Choose the one that best suits your needs. Make sure you understand your coverage before getting one.